»I should also like to inform our distinguished customers that on August 1, 1892, I purchased the factory business previously operated under the name of H. Trommsdorff in Erfurt and Gispersleben.«

Communication from E. Merck, Darmstadt, Germany, July 1, 1893

Merck from Darmstadt, Germany, is one of the world’s oldest pharmaceutical and chemical company. Being in good condition at an advanced age clearly proves that the organization has successfully navigated the constantly shifting social, political, economic, and scientific tides.

This achievement has required many small and large steps – not least acquisitions. Strictly speaking, even the founding of the company is a takeover. The pharmacist Friedrich Jacob Merck, born in Schweinfurt, comes to Darmstadt and acquires the second city pharmacy built in 1654 – later to become the Engel-Apotheke– for a »sizeable amount of money«. On August 26, 1668 Landgrave Ludwig VI of Hesse-Darmstadt grants him a license to operate a pharmacy. The first actual acquisition is the purchase in 1892 of the chemical factory »H. Trommsdorff zu Erfurt und Gispersleben«, founded in 1836.

Following a number of important take overs in the 1990s, acquisitions are a central component of a growth strategy, especially in the early 21st century. With a purchase price of € 10.3 billion, the transformational acquisition of Serono in 2007, through which Merck KGaA, Darmstadt, Germany, becomes a leading biotech company, is the largest acquisitionin the company’s history at the time. It’s no secret that the company plans to strengthen its pharmaceutical business. In 2006, the company attempts to take over Schering, but Bayer wins the bidding war. Merck KGaA, Darmstadt, Germany, soon surprises everyone with its offer to acquire Serono S.A. of Geneva, Switzerland. Managed by the Bertarelli family, the biotech company meets the requirements placed on the company strategy: achieving a critical mass in R&D, strengthening the development pipeline and the product portfolio as well as improving the global presence, especiallyin the United States.

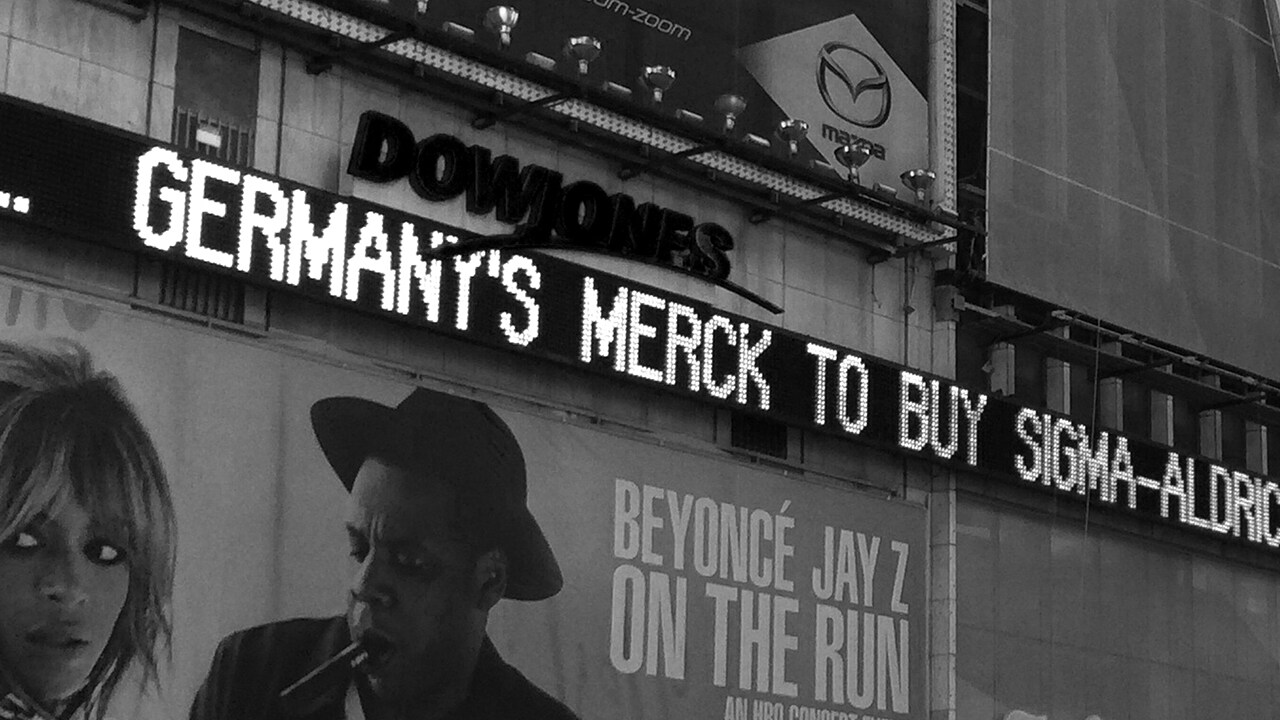

With the acquisition in 2010 of the Millipore Corporation, a leading life science company headquartered in Billerica, Massachusetts, USA, Merck KGaA, Darmstadt, Germany, continues its strategy of focusing on profitable, high-growth specialty products. The aggregate purchase price including debt and cash is approximately € 5.2 billion. By acquiring AZ Electronic Materials in 2014, the company becomes a leading supplier of solutions inthe premium high-tech materials and functional specialty chemicals segments. In 2015, the company completes the takeover of Sigma-Aldrich, marking the largest acquisition in the company’s history (volume: US$ 17 billion) and making Merck KGaA, Darmstadt, Germany, a leading player in the life science industry.

In 1906, Cesare Serono establishes the Istituto Farmacologico in Italy, initially specializing in the extraction and purification of natural active ingredients. In 2007, Merck KGaA, Darmstadt, Germany, acquires this Geneva based biotechnology company, now called Serono S.A., for € 10.3 billion.

The acquisition of the Millipore Corporation in 2010 creates a better balance between Pharmaceuticals and Chemicals at Group level. Founded in 1954 by Jack Bush as a research-based company specializing in filters, Millipore strengthens the company’s position as an important partner for the life science industry.

The Sigma Chemical Company, founded in 1946, and the Aldrich Chemical Company, founded in 1951, merge in 1975 to form Sigma-Aldrich. In 2015, Merck KGaA, Darmstadt, Germany, acquires the laboratory supplier, a pioneer in the field of e-commerce, for US$ 17 billion – then the largest acquisition in the company’s history.