textblock default title

»Merck [KGaA, Darmstadt, Germany] has invested very heavily over the past four years [...]. In addition, we have further plans for expansion.«

Hans Joachim Langmann on the planned public offering, 1995

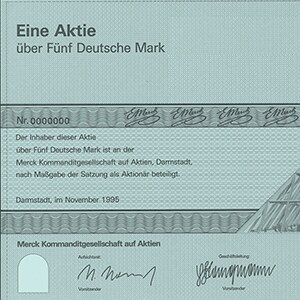

In May 2011, a historic event takes place on the Frankfurt Stock Exchange. After 425 years, floor trading is discontinued. Going forward, all transactions run viathe electronic trading system Xetra. At the time, Merck KGaA, Darmstadt, Germany, had already been on the stock market for 16 years, a constituent of the M-Dax index since 1995 and of the DAX blue-chip index comprising Germany’s 30 largest publicly traded companies since 2007. The transformation into a corporation with general partners (Kommanditgesellschaft auf Aktien – KGaA) and market capitalization in the mid-1990s gives the company greater entrepreneurial scope again and thus forms the basis for future investments. After a long phase of expansion, not only sales but also financial debt at the company had grown considerably. The public offering is an overwhelming success. With an issue volume of DM 2.4 billion, this represents the largest public offering in German history at that time. In 1995, the Merck family holds a 74% stake in the company through E. Merck, Darmstadt, Germany, the general partner. The full amount of DM 2.4 billion goes to the company.

The idea of a company reorganization is not new. Thought had already been given to forming a stock corporation (AG) back in 1912. Willy Merck, one of the partners, wants to see »this matter« pursued more rapidly. He looks »with a certain degree of concern into the future«. The company is possibly alluding to an idea that is found in the minutes of the community of interests with Boehringer, Knoll, Gehe and Riedel in November 1911: The transformation of the company into a stock corporation and merger with the partners.

Under different circumstances, the discussion after World War I re-emerges. After a successful fiscal 1920, an ever faster economic downturn is also expected at E. Merck, Darmstadt, Germany, amid an increasing process of consolidation throughout the entire industry. The need to increase the company’s own liquidity is urgent. In addition, the change in legal form offers the company the possibility to form collaborations itself. The formation of a stock corporation is only one of several options to counteract the lack of capital. Lastly, the company cooperates closely with the Danat-Bank to bridge the difficult loan situation.

Between 1953 and 1970, a family stock corporation is indeed in existence. It is spun off from the general partnership, which has existed for around 100 years, as an operating company. Tax reasons play just as much a role as the ease with which greater financial flexibility can be achieved in the future. In addition, the legal framework of a stock corporation is the option favored by executives. The change in the company’s legal form can also mean more attractive professional opportunities.

October 20, 1995 is the first day of trading for Merck KGaA, Darmstadt, Germany, shares in Frankfurt and Zurich. The shares are oversubscribed five-fold. 45 million ordinary bearer shares of DM 54 each are issued. This represents 26% of the company’s total capital. In 1996 the first publicly held Annual General Meeting in the history of the company takes place.

E. Merck Aktiengesellschaft, Darmstadt, Germany, is not a publicly traded company. The shares are held entirely by Emanuel Merck oHG, which represents all the family members. In 1968 Hans Joachim Langmann, Emanuel W. and Peter Merck, general partners of Emanuel Merck oHG, Darmstadt, Germany, also become members of the Executive Board of E. Merck AG in Darmstadt, Germany.

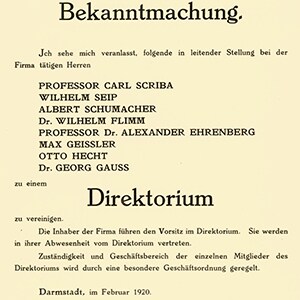

With the formation of a Board of Directors in 1920, the management structure of the company changes decisively. The management of operating business now consists of a group of company owners from the family as well as non-family directors. This expansion of expertise contributes substantially to the development in the years that follow.